A Biased View of Thomas Insurance Advisors

Wiki Article

A Biased View of Thomas Insurance Advisors

Table of Contents3 Easy Facts About Thomas Insurance Advisors ExplainedThomas Insurance Advisors Things To Know Before You Get This4 Simple Techniques For Thomas Insurance AdvisorsThe Main Principles Of Thomas Insurance Advisors

Your excellent health and wellness is what enables you to function, earn money, and enjoy life. You may find on your own not able to obtain therapy, or required to pay large medical costs." Not having coverage can be economically ravaging to households due to the high expense of treatment." Health insurance gotten through the Industry can even cover preventative services such as vaccines, testings, as well as some examinations. That means, you can keep your health as well as wellness to meet life's demands. If you're independent or a freelancer, you can subtract health insurance premiums you pay of pocket when you file your tax return.

5% of your adjusted gross income. How crucial is it truly? "The requirement for life insurance coverage differs, as well as it transforms over time," discussed Stephen Caplan, CSLP, a financial expert at Neponset Valley Financial Partners.

If they are accountable for supporting a household, making certain sufficient security is essential." If you're wed with a family members when you die, what can life insurance policy do? It can replace lost income, help pay debts, or pay for your children's college education. If you're single, it could pay for funeral costs as well as repay any kind of financial obligations you leave.

About Thomas Insurance Advisors

" As opposed to what numerous people think, their house or vehicle is not their best asset. Rather, it is their capacity to make an income. Yet, many professionals do not guarantee the chance of an impairment," claimed John Barnes, CFP and owner of My Family Life Insurance. He went on to claim: "An impairment occurs much more often than individuals assume." The Social Protection Management estimates that a special needs happens in one in four 20-year-olds before they reach old age.

Still, Barnes advises that worker's comp "does not cover off-the-job injuries or ailments like cancer, diabetic issues, numerous sclerosis, or even COVID-19." The bright side is that handicap insurance isn't likely to break the bank; it can frequently suit a lot of spending plans. "Typically, the premiums of impairment insurance cost 2 cents for every single buck you make," stated Barnes.

The smart Trick of Thomas Insurance Advisors That Nobody is Talking About

Identification burglary insurance coverage covers any kind of losses you might incur if someone takes your identification. Long-lasting care insurance policy covers you if were ever before to require an assisted care center, such as an assisted living facility or a rehab facility. Traveling insurance coverage is typically a temporary plan that you get simply for the duration of a trip, specifically one beyond the U.S.

if you were to drop unwell or be injured overseas. Umbrella insurance coverage covers you for obligation above and beyond your routine plans. If something occurs outside your home that you could be liable for however that your house or automobile insurance won't cover you for, an umbrella plan would certainly fill up that space.

Entire life plans also get to a point where the insurance holder can cash out a portion of the policy.

The Main Principles Of Thomas Insurance Advisors

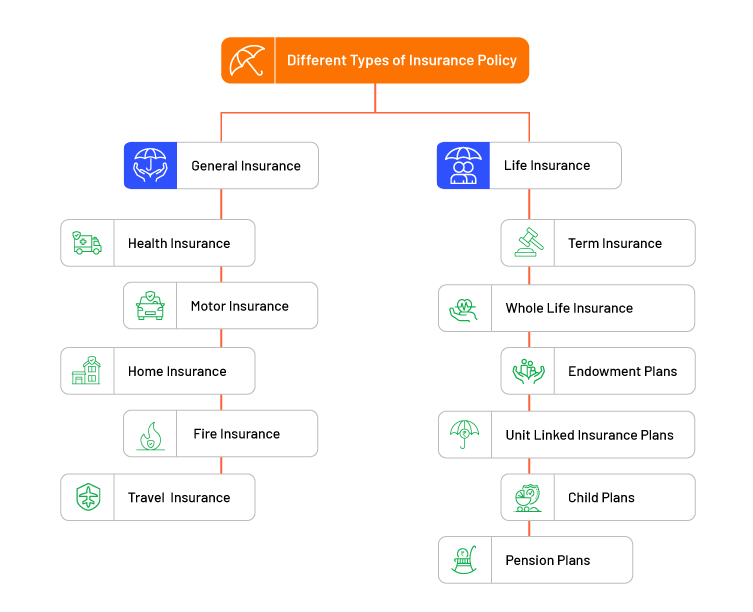

Duration: 6 minutes Learn more about the different types of insurance coverage to aid you consider what you may as well as may not need. Health insurance/Supplemental medical insurance HSAs/Health Cost savings Accounts Impairment insurance Life insurance policy Long-term treatment insurance Estate preparationVarious kinds of strategies aid you obtain as well as pay for treatment differently. A traditional kind of insurance coverage in which the health and wellness plan will certainly either pay the medical supplier directly or repay you after you have filed an insurance case for every covered medical expenditure. Medicare/ Medicaid in Toccoa, GA. When you require medical focus, you visit the medical professional or health center of your choice (https://triberr.com/jstinsurance1).

An FFS option that permits you to see medical providers who minimize their costs to the plan; you pay less money out-of-pocket when you utilize a PPO service provider. When you check out a PPO you normally will not have to submit insurance claims or documentation. However, going to a PPO healthcare facility does not assure PPO advantages for all solutions received within that medical facility.

A lot of networks are rather large, yet they may not have all the doctors or health centers you want. This technique generally will conserve you cash - Final Expense in Toccoa, GA. Generally registering in a FFS plan does not ensure that a PPO will be readily available in your location. PPOs have a more powerful existence in some regions than others, and in areas where there are local PPOs, the non-PPO advantage is the typical advantage (https://profile.ameba.jp/ameba/jstinsurance1).

Report this wiki page